2 week application sprint exploring Home Insurance and Welath Management concepts

Summary

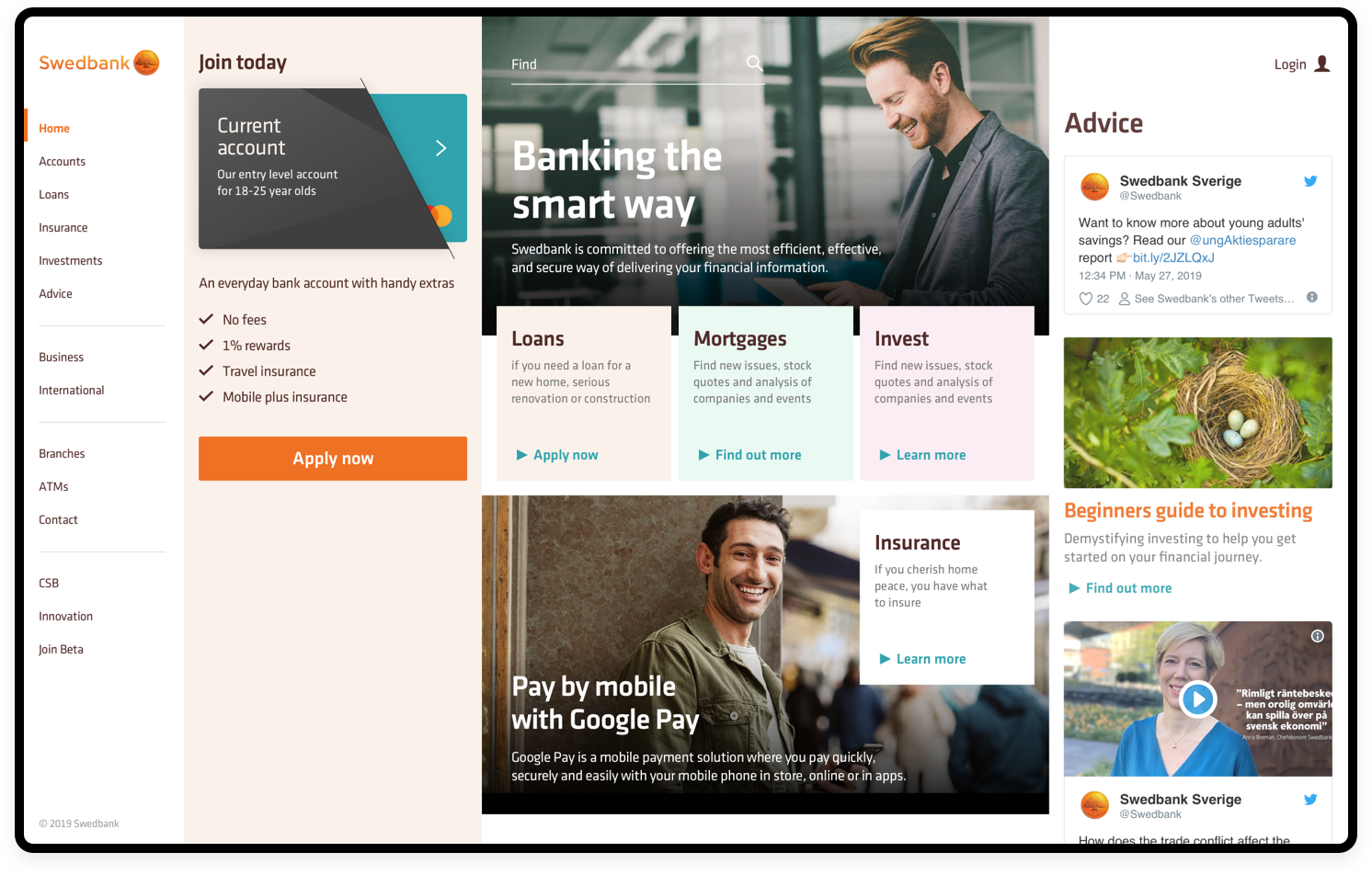

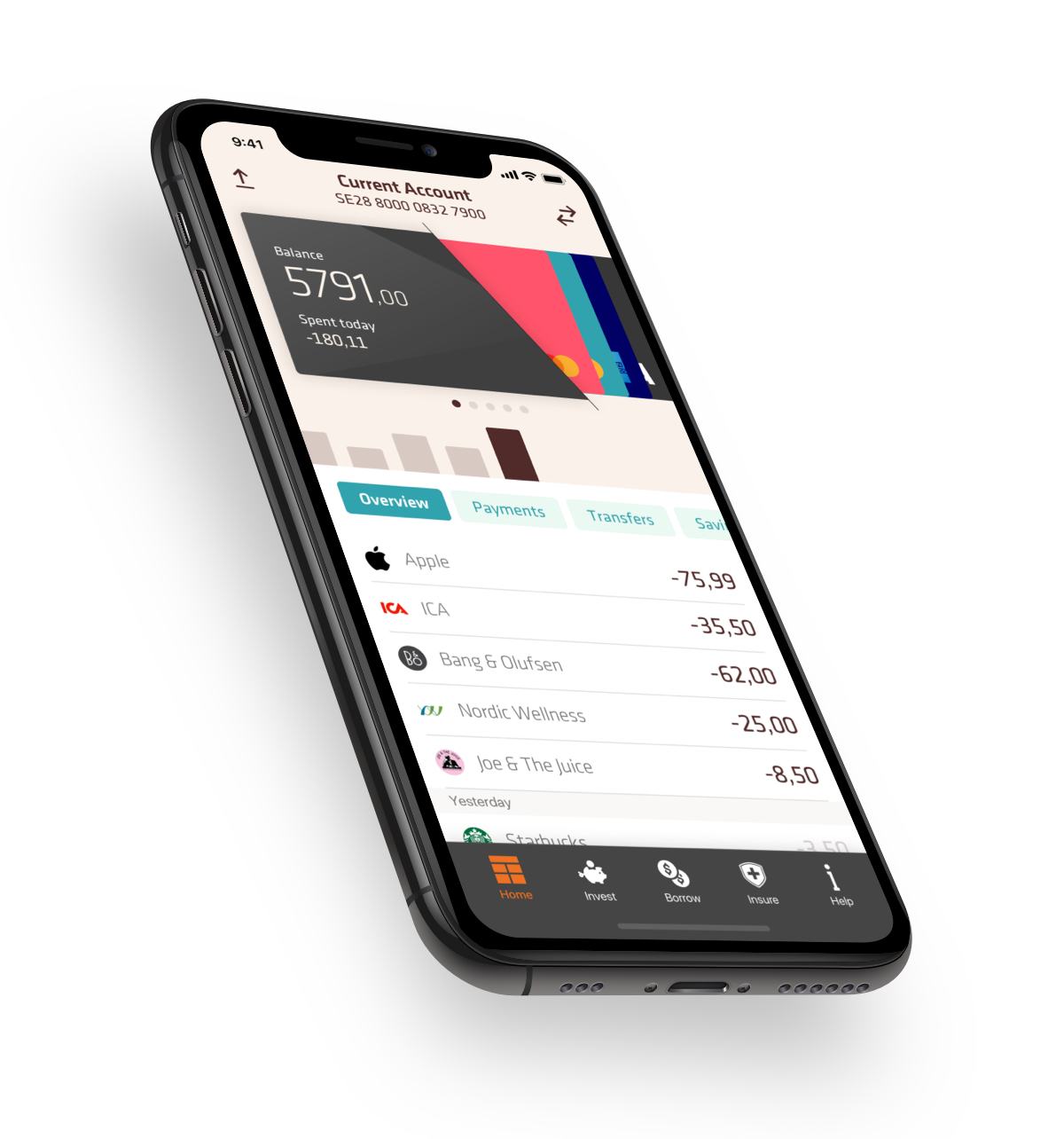

A 2 week rapid connected design sprint to understand the needs of the Swedbank customers by creating innovative product and service offerings that drive revenue, value, adoption and brand loyalty. Delivering high fidelity prototypes and an iOS build POC of the Home Insurance epic. Due to the short time window we worked with a Swedbank stakeholder to help accelerate the process and use them as a sounding board for brand validation whilst creating the visual designs, ensuring we could make the experience true to the Swedbank brand.

Services

Lead Designer, UI/UX

Client

Swedbank (2019)

My role & responsibilities across the program

• Lead designer in charge of delivering the visual design templates for the program.

• Collaborating with the lead UX on the program to take annotated sketches straight into design, bypassing the wireframe stage.

• Creating micro-interactions for certain templates, to both communicate the interaction to developers, and to sell the experience to stakeholders.

• Creating click-through prototypes for both epics in Invision to be used for validation, and preparing all assets for handover to technical build teams.

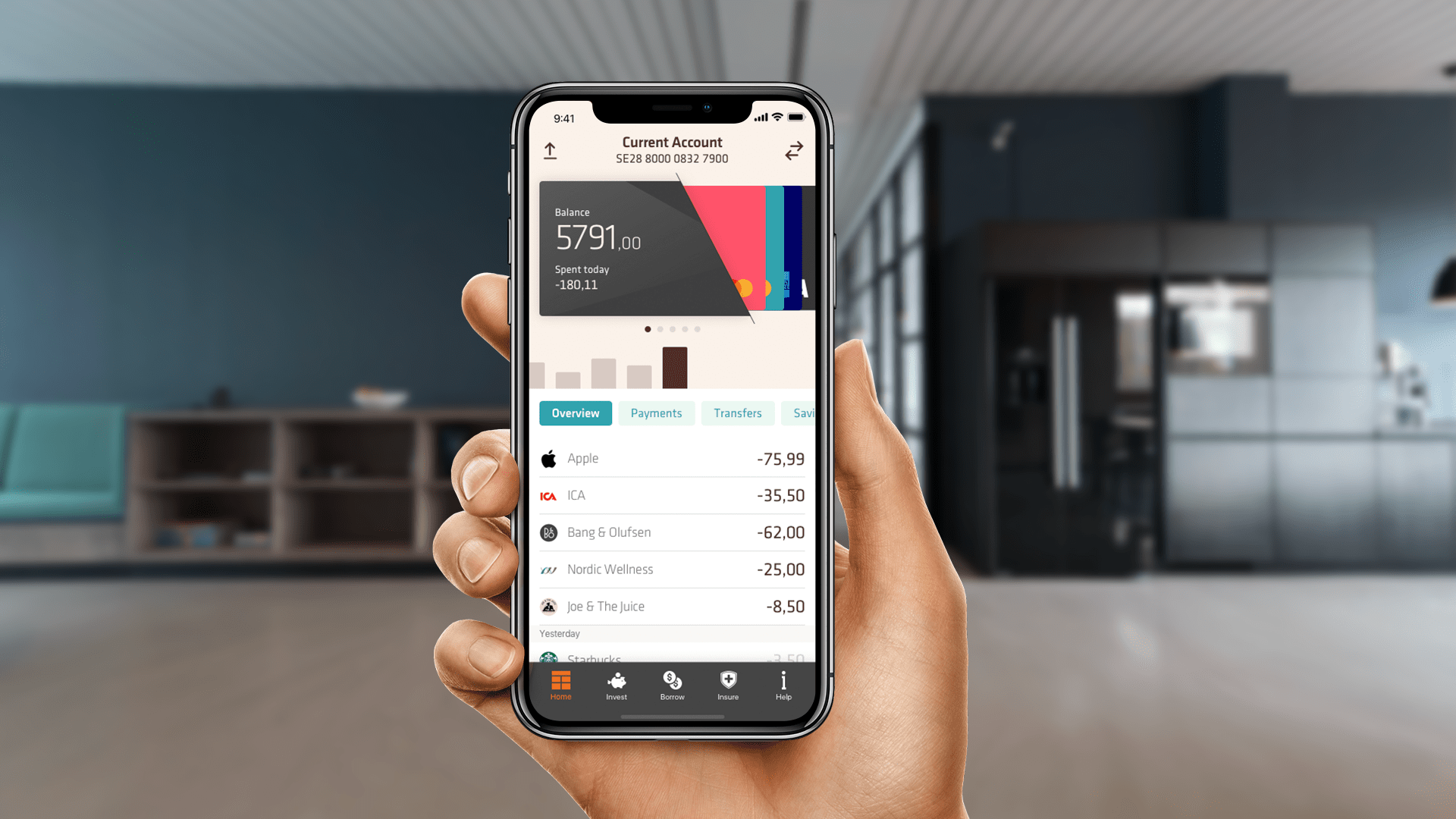

A new connected digital Home Insurance experience for Hugo

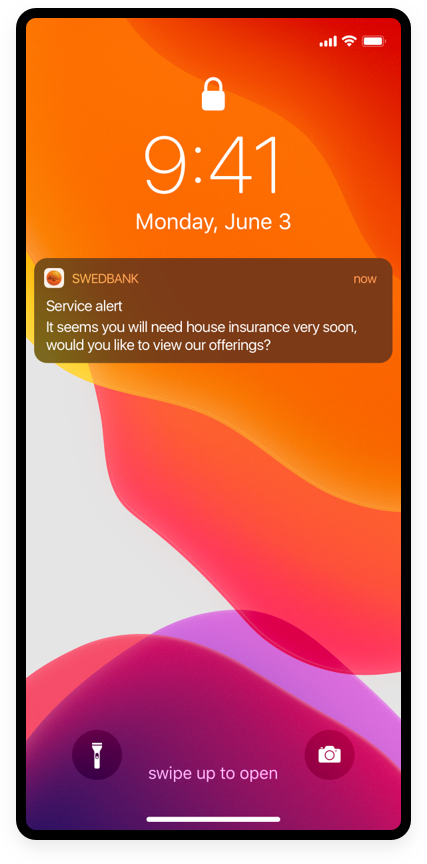

Hugo is a Swedbank customer and manages his banking through the app. He currently has Home Insurance with another provider.

Opportunities to upsell Swedbank products and services to Hugo is available by utilizing open banking APIs to determine his current home insurance product is about to expire.

• Re-imagined information Architecture

• A more intuitive navigation and usability whilst moving through the app

• Assisted help, product education, upselling

• More personalized experience based upon daily tasks and product purchasing

• Use open banking PSD2 to allow for visualization of data form accounts in this summarized PFM view

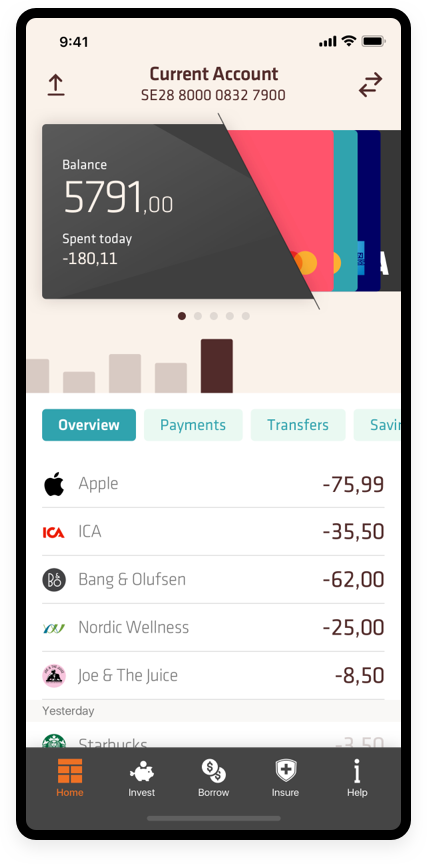

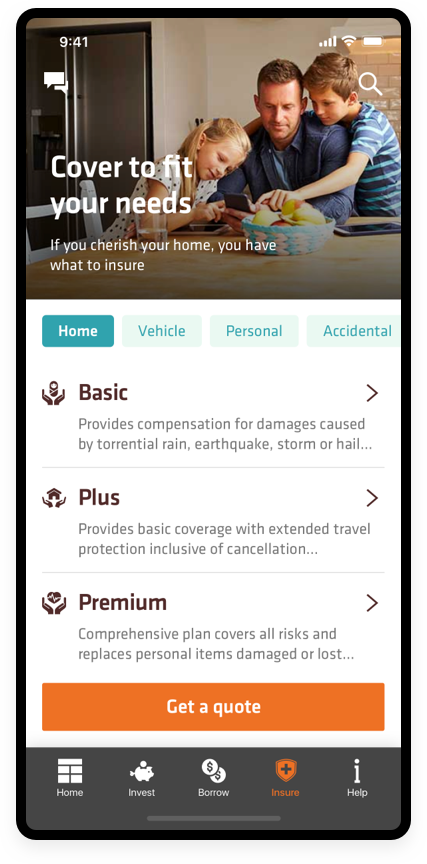

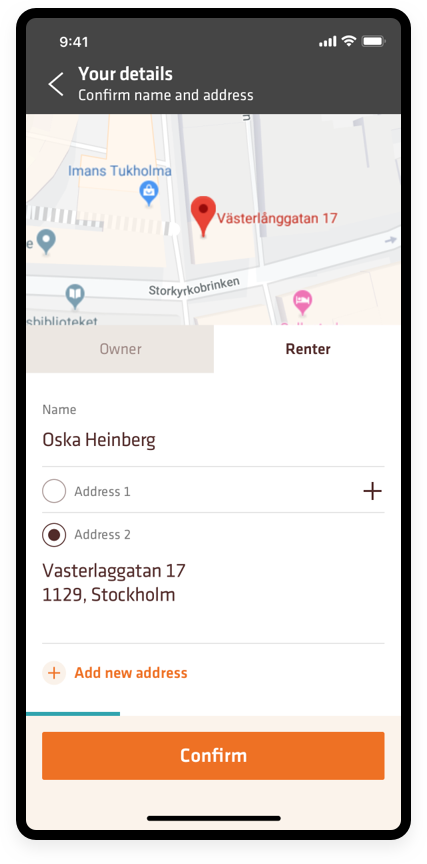

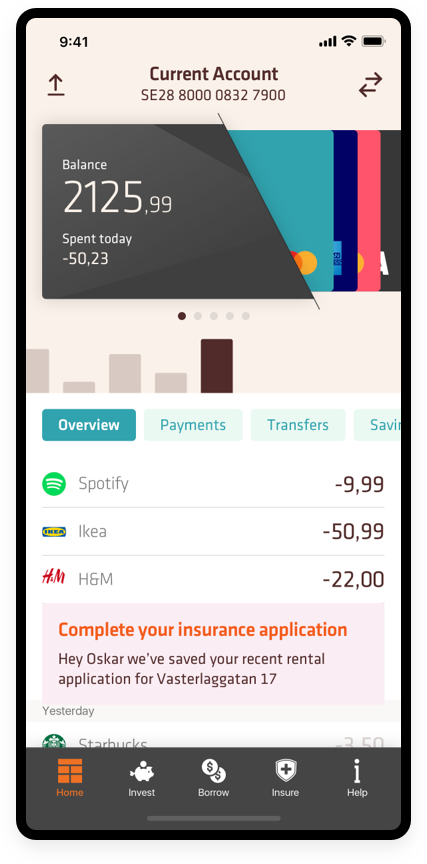

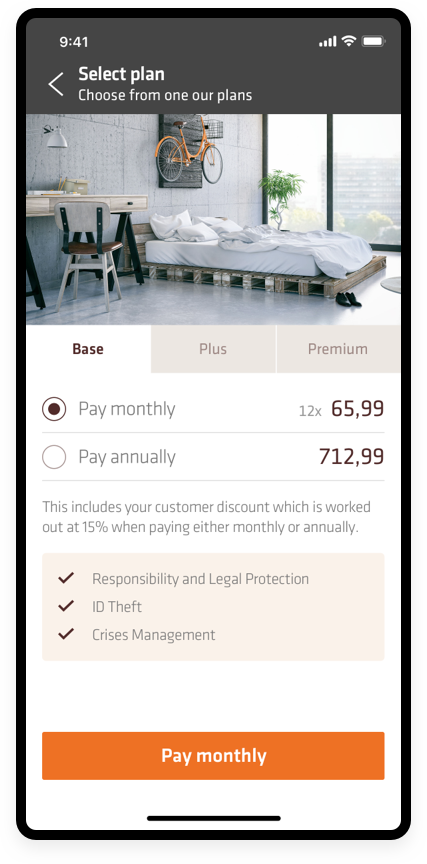

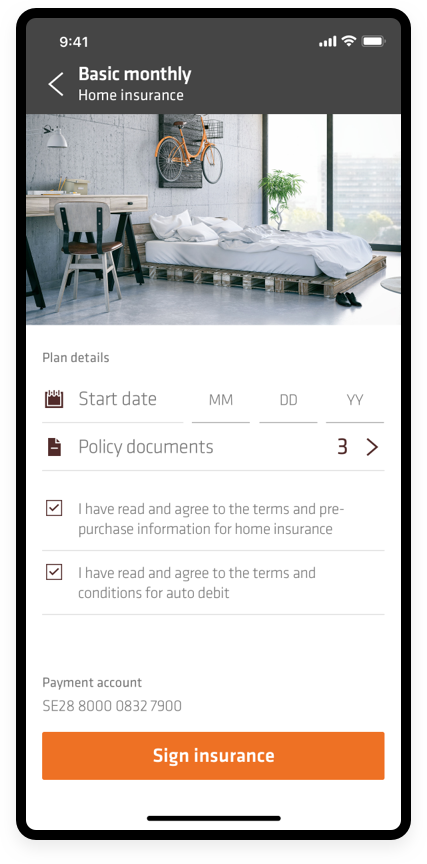

A new connected digital Home Insurance experience for Oskar

Oskar is a Swedbank customer and manages his banking through the app. He currently has Home Insurance with another provider.

Opportunities to upsell Swedbank products and services to Oskar is available by utilizing open banking APIs to determine his current home insurance product is about to expire.

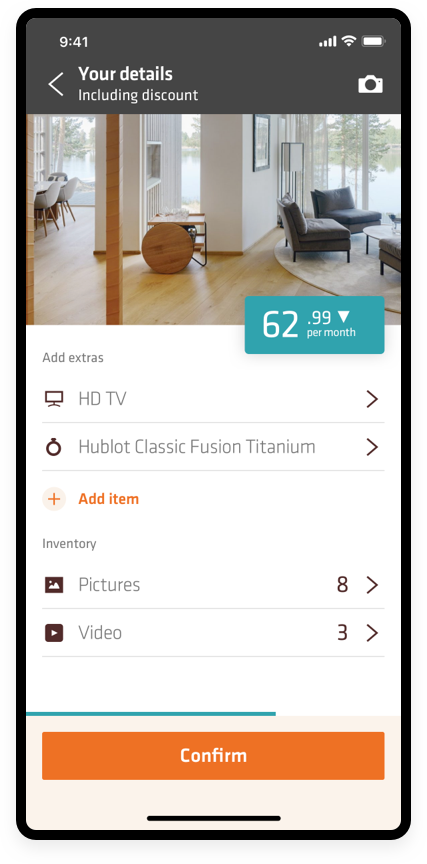

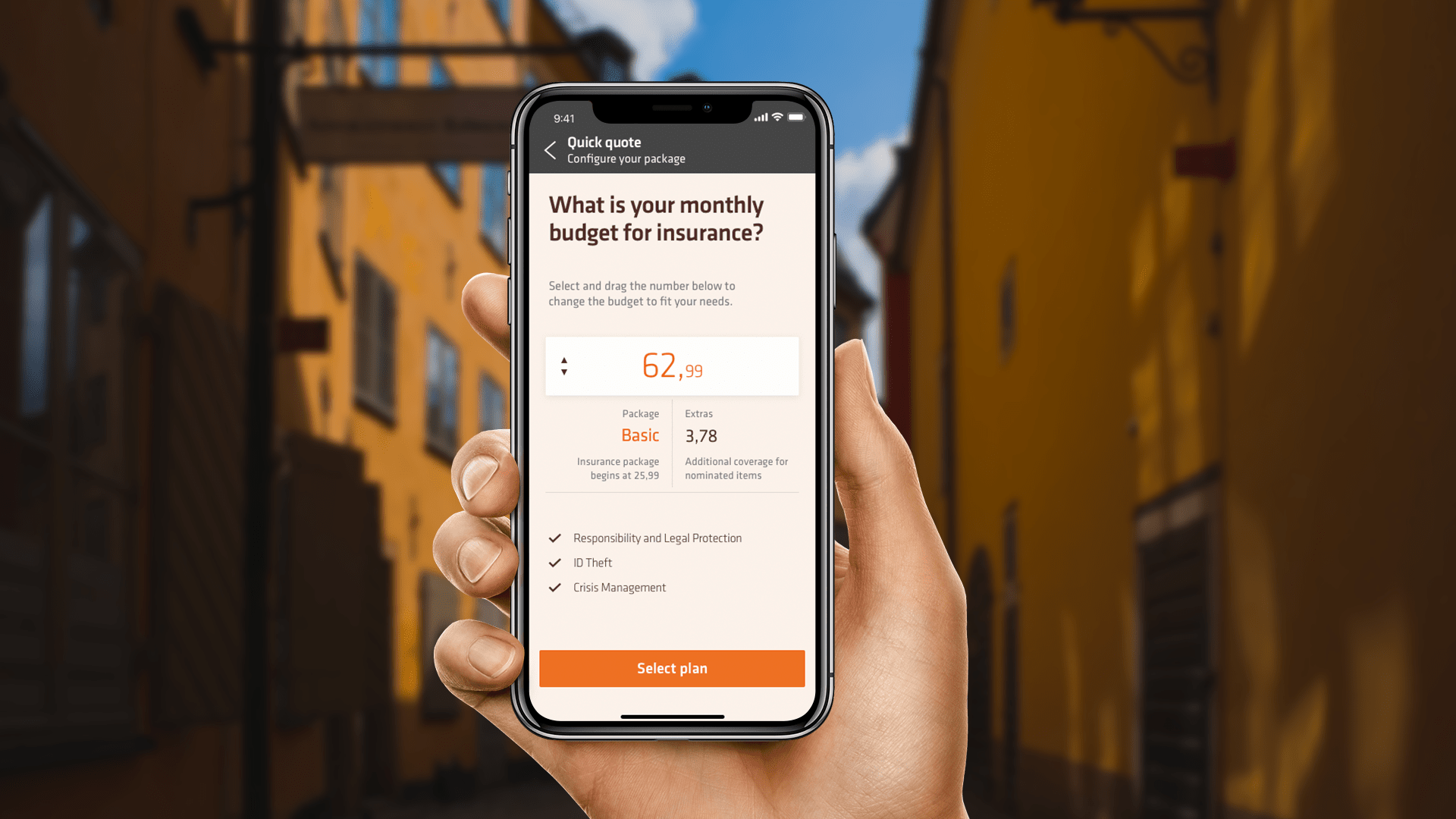

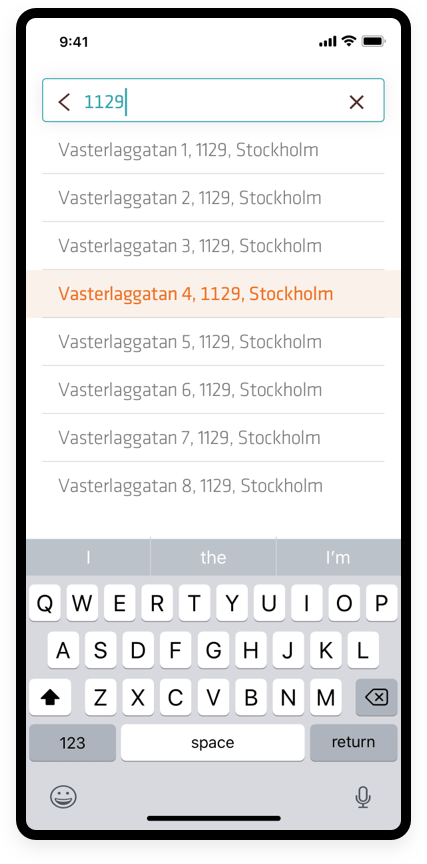

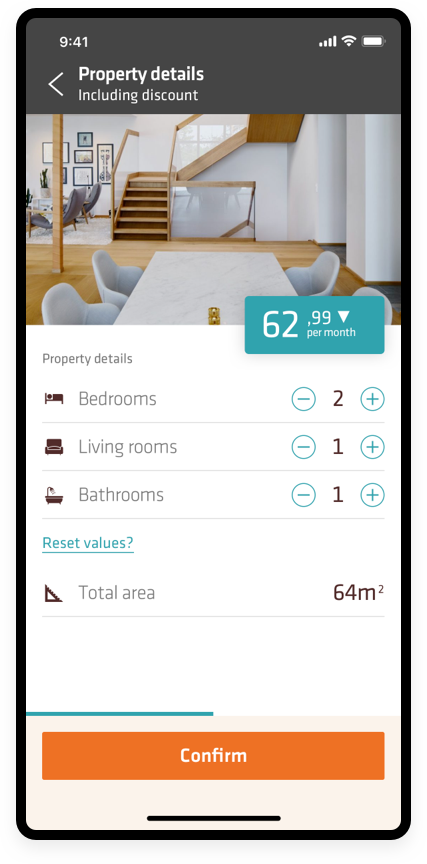

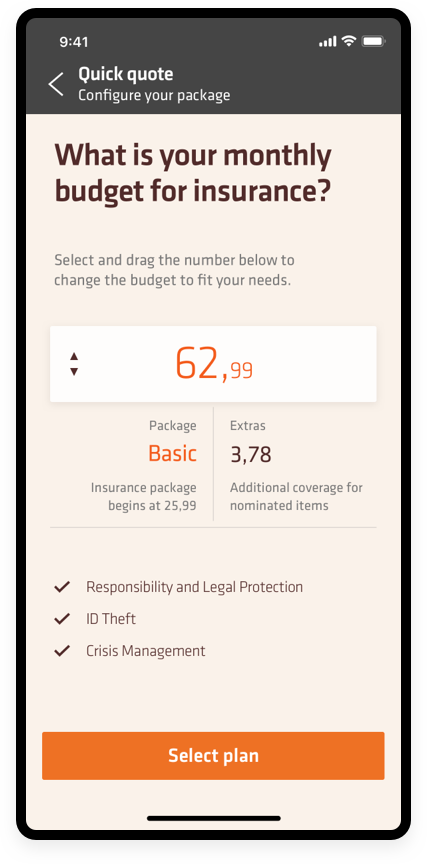

• Plan insurance by your budget

• Get a quick on the spot quote with minimal information and manual inputs

• Autosave allows Oskar to come back

later to complete the application

• Instantly see what is covered and what is not covered

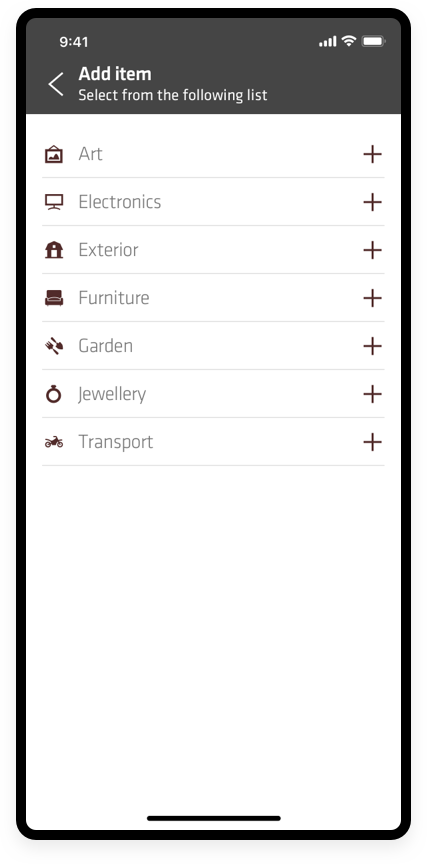

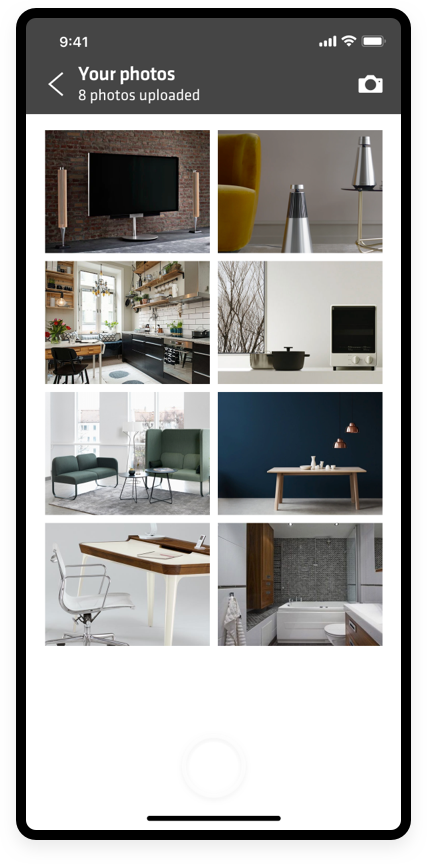

• Configure coverage for any extra additional items of content

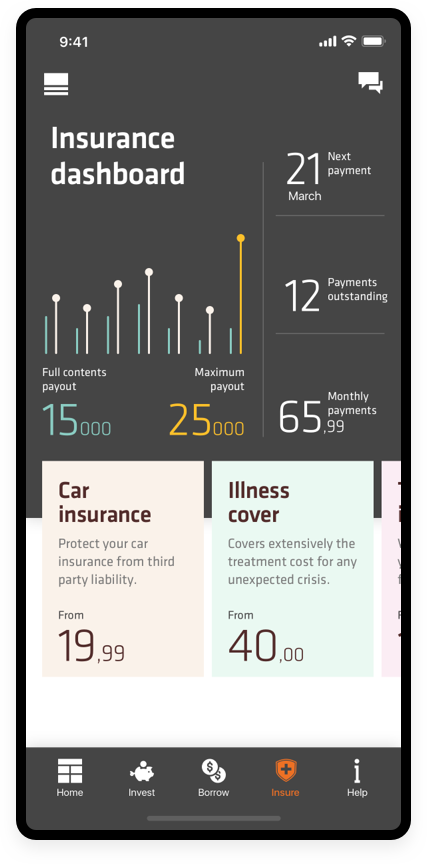

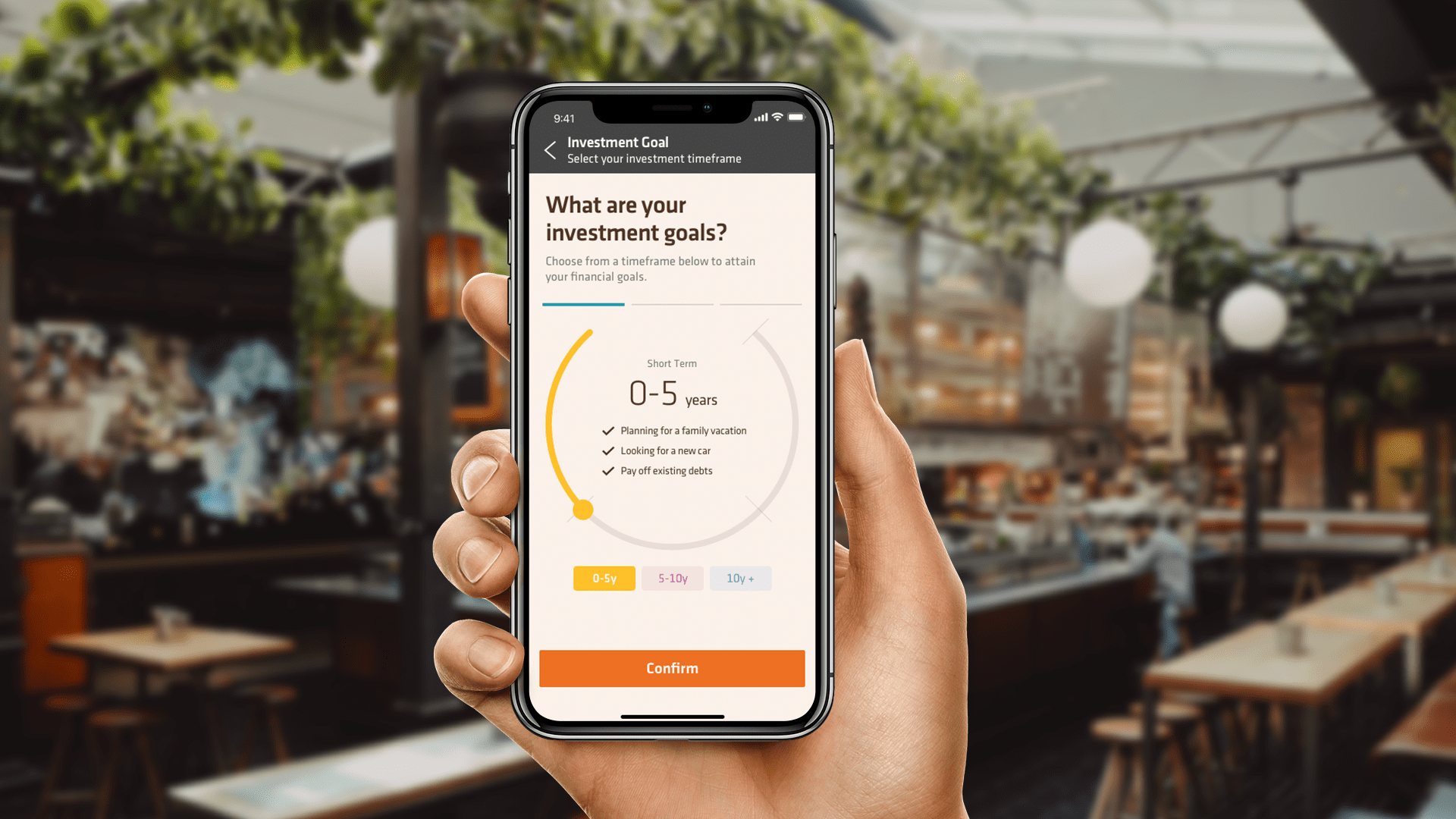

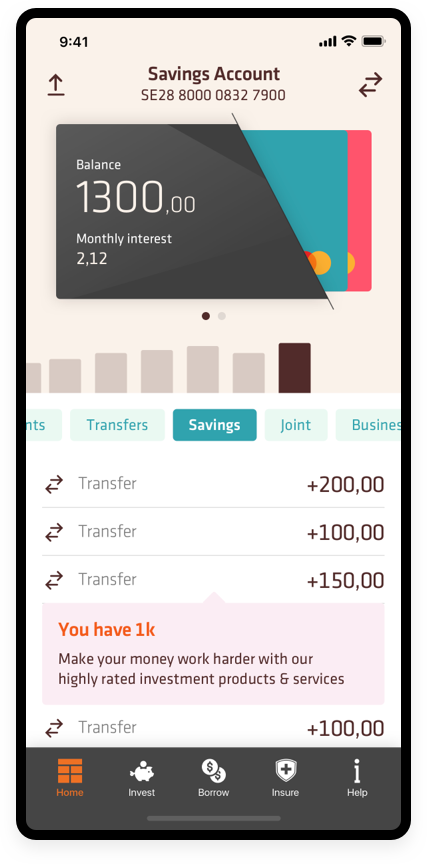

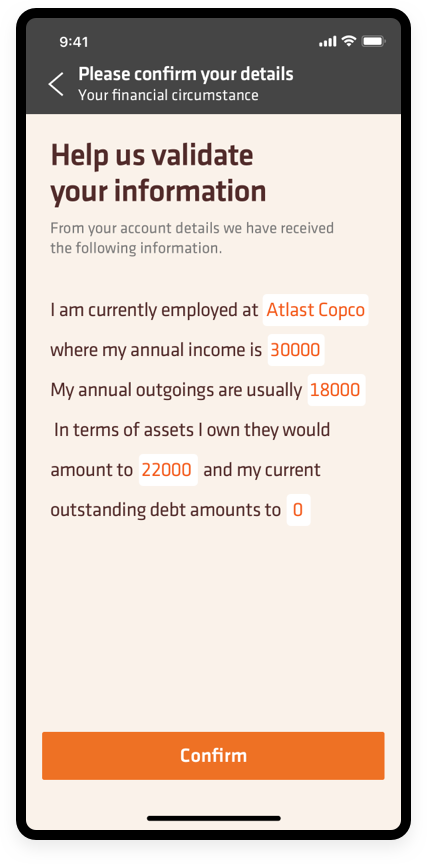

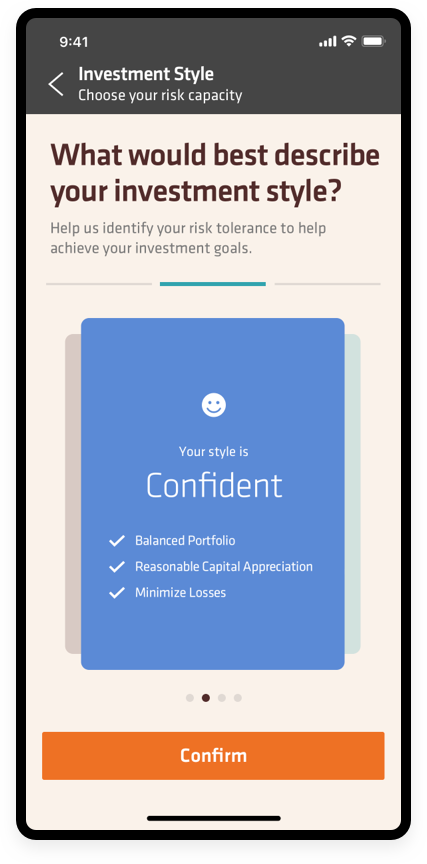

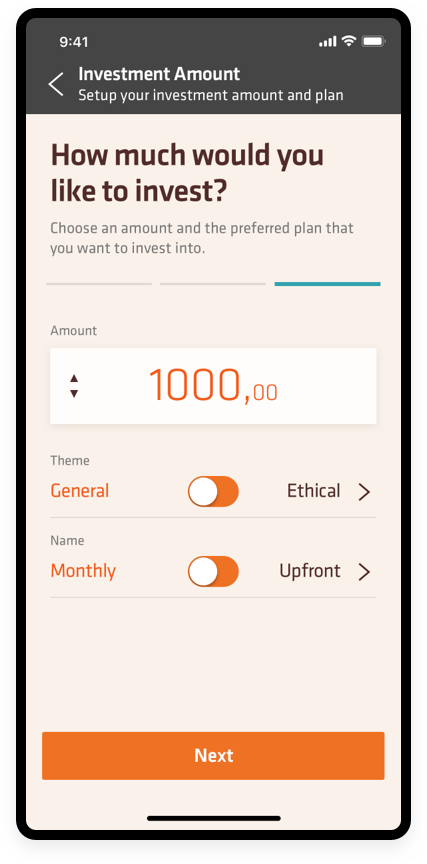

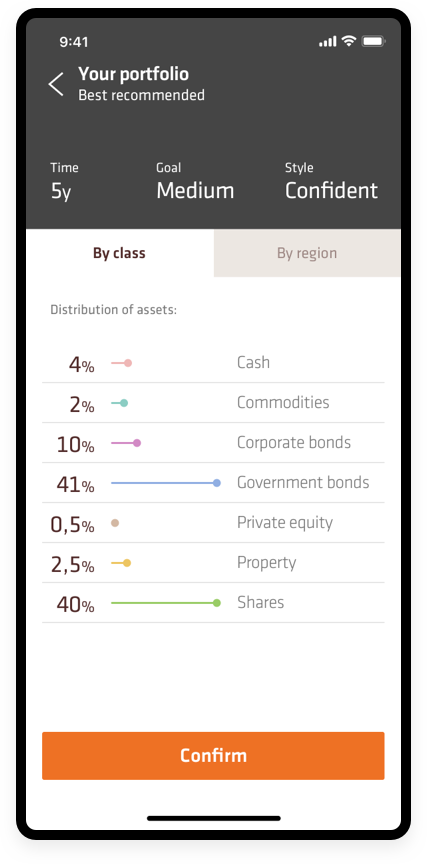

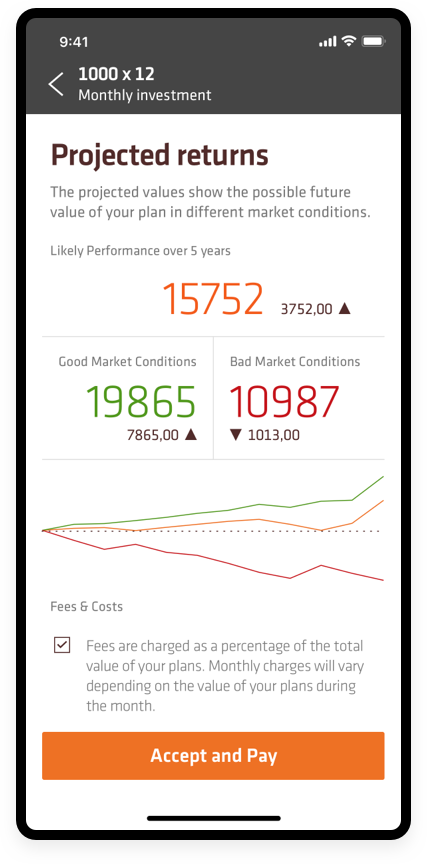

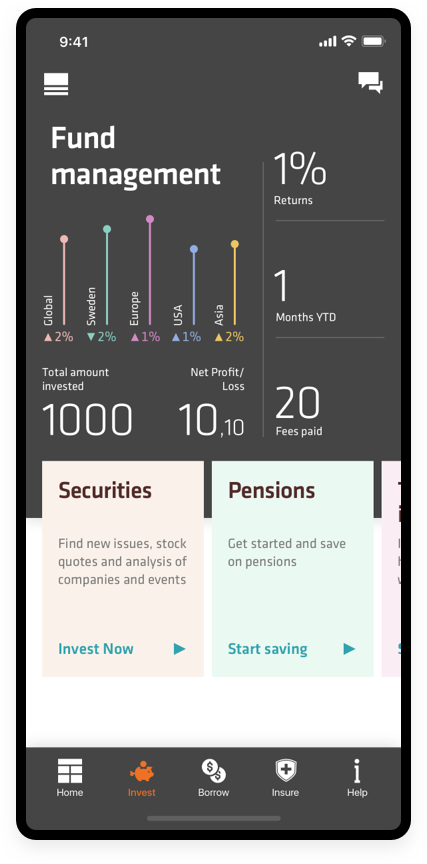

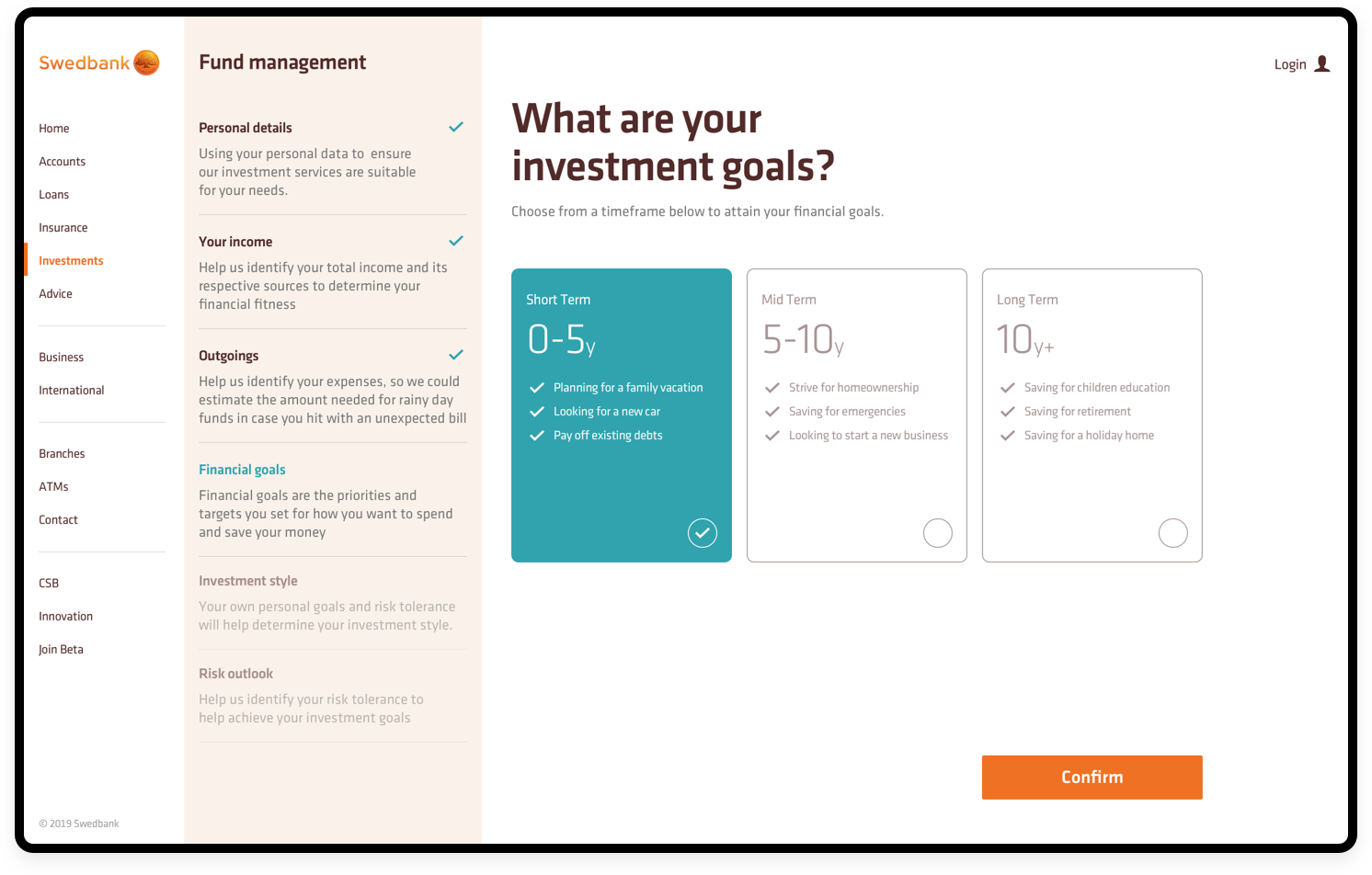

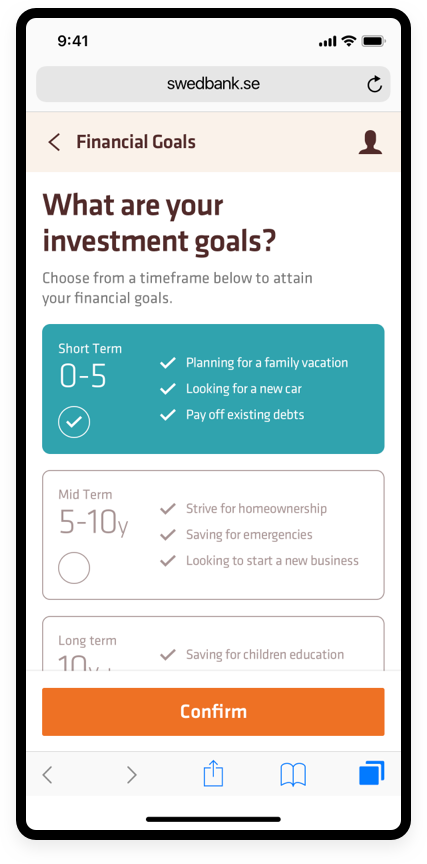

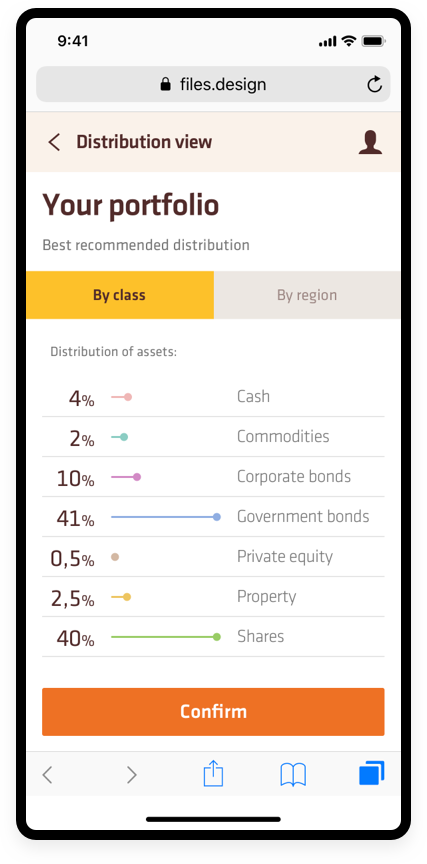

A new Wealth Management experience for Oskar

Oskar has been passively saving surplus cash on a monthly basis, not actively taking in what he’s doing or even how much he’s got.

Ideally he would like to use the money as a deposit to purchase his first property but knows he would need to save a considerable amount more to achieve his goals.

• Intuitive journey of questions

• Easy investment configuration

• Embedded with PSD2 to ensure data connection with other sources

• Data rich in app visualization of funds and the distribution of those funds

• Post purchase dashboard to allow Oskar to track his progress on a daily basis

• Native enhanced experience

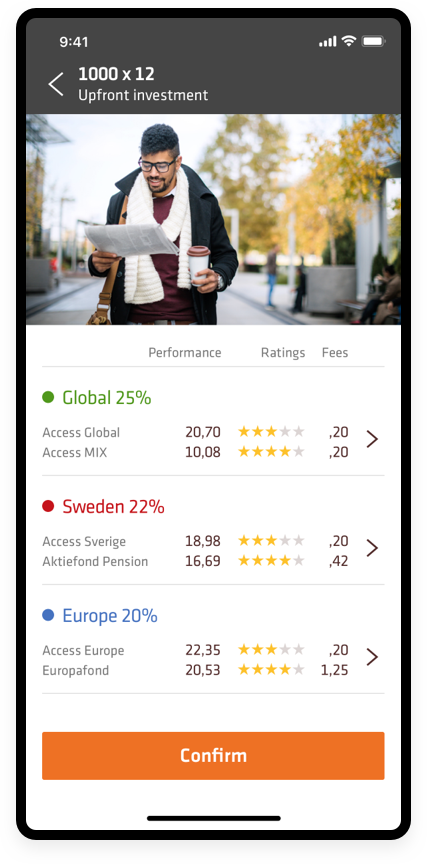

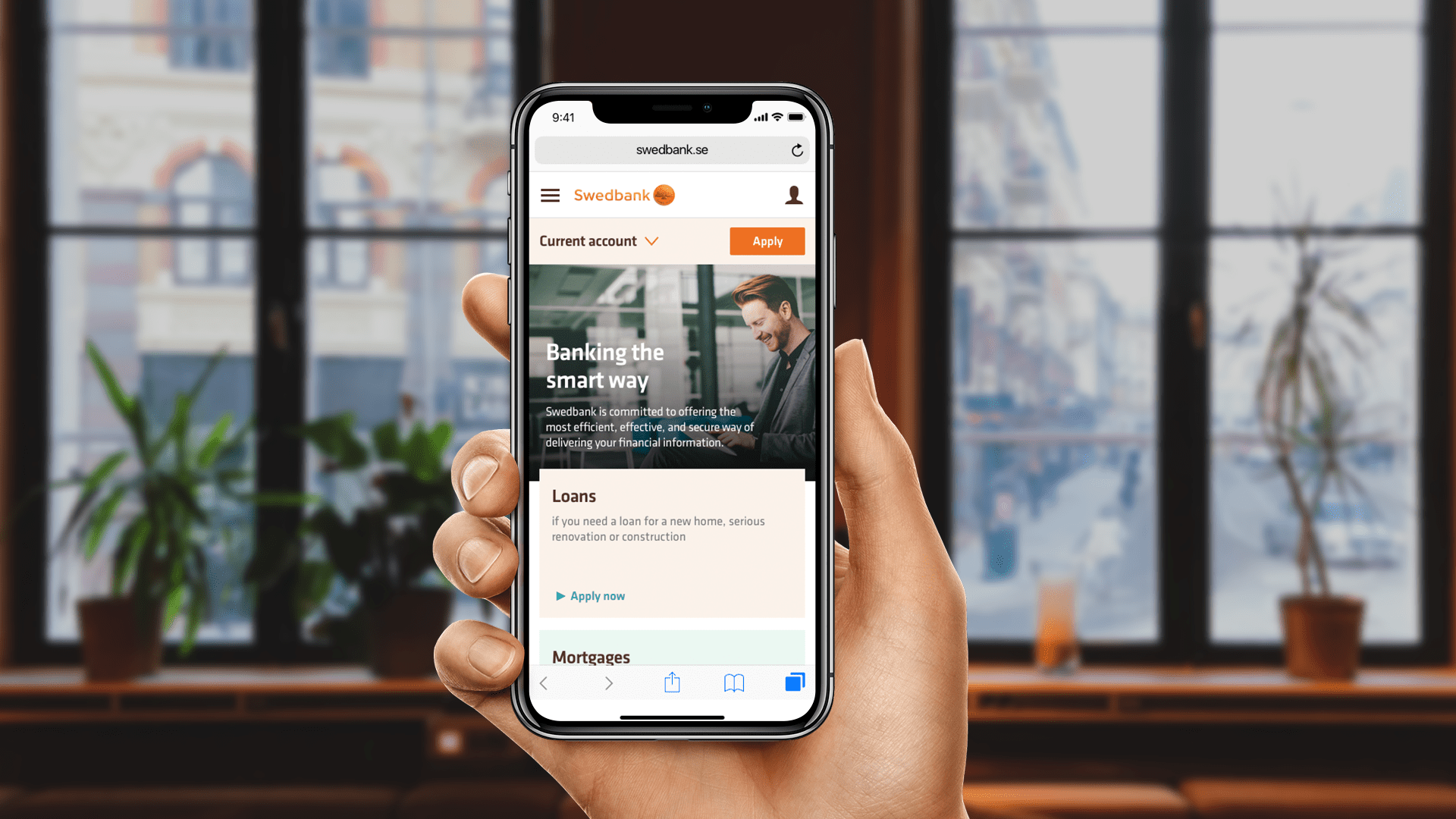

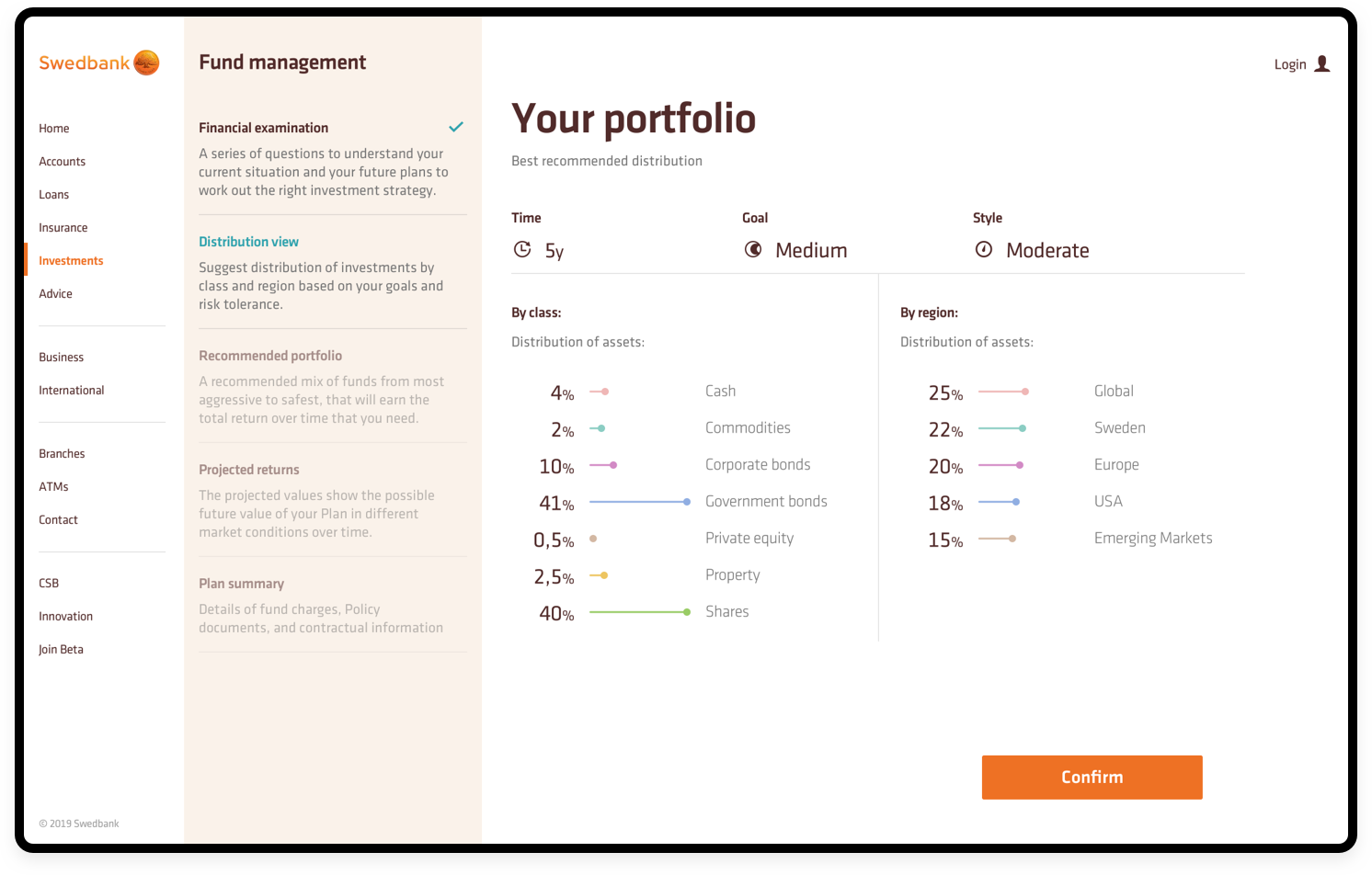

A new Wealth Management online experience for Olivia

Olivia is 62 years old and will be retiring in the next three years. She would like to top up her pension with a possible additional investment.

She’s been researching online and aggregator has offered her a view of lowest fees with potential ethical investment and is taken to the Swedbank website